Panipuri Vendor Gets GST Notice After Earning Rs 40 Lakh, Internet Divided

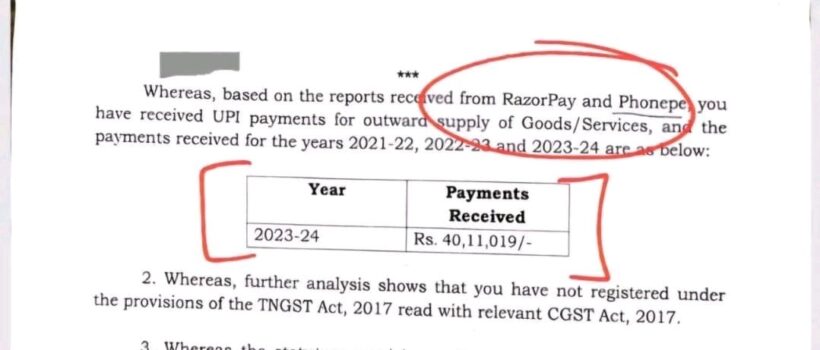

The notice directed the vendor to appear in person and present financial documents related to his transactions over the past three years. A pani puri vendor from Tamil Nadu has come under the Goods and Services Tax (GST) authorities’ scanner after reportedly receiving online payments amounting to Rs 40 lakh during the 2023-24 financial year. […]